How Coronavirus-Impacted Businesses Can Use the Employee Retention Tax Credit

With many American businesses around the country struggling due to the coronavirus pandemic, the government responded by passing multiple stimulus packages and tax credits.

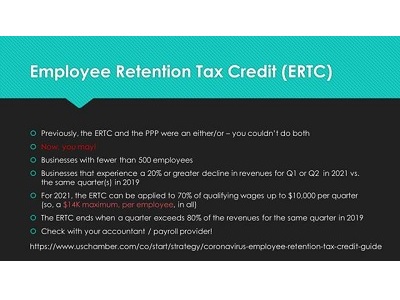

One crucial tax credit businesses should know is the Employee Retention Tax Credit (ERTC).

The ERTC was originally included in the Coronavirus Aid, Relief, and Economic Security (CARES) Act, but it was not widely used because initially, businesses could only take advantage of either the Paycheck Protection Program (PPP) or the ERTC. But Congress revised this provision in December 2020, meaning many more companies may now qualify to receive PPP loans and use the ERTC.

The ERTC has been designed to incentivize businesses of all sizes to keep employees on their payroll during this period of economic hardship.

As of December 2020, employers with 500 or fewer employees are able to claim the ERTC if they had a revenue reduction in 2020. Specifically, businesses that experienced a decline in gross receipts by more than 20 percent in any quarter of 2020 compared to the same quarter in 2019 are eligible.

Additionally, eligibility ends if gross receipts in a 2020 quarter exceed 80 percent compared to the same quarter in 2019. For example, this means if your business has a 2020 third quarter where revenue is down 21 percent, but then your 2020 fourth quarter has revenue up by 81 percent, then you only qualify up to the third quarter.

Regarding tax-exempt organizations that fall under 501(c) categorization, they must have partially or fully suspended all operations in 2020 or 2021 to qualify.

Also, employers may not claim the same employee for this credit and the Work Opportunity Tax Credit for the same period.

Importantly, employers that received a PPP loan and those who receive second draw PPP loans can also be eligible for the ERTC. However, PPP funds and ERTC can not be used to cover the same payroll costs.

For more details and information, CLICK HERE.

(Information courtesy US Chamber of Commerce.)